Mortgage Rates In Canada 2024. If you’re looking for the best mortgage rates in ontario, you’re in the right place. As of march 2024, the market consensus on the mortgage rate forecast in canada is for the central bank to hold the prime rate at 5% at its april 10, 2024 meeting and cut rates by 0.25% at its july 24 meeting.

Best mortgage rates in ontario. If you’re looking for the best mortgage rates in ontario, you’re in the right place.

Fixed Vs Variable Mortgage Rates.

The prime rate is determined by the banks themselves, and it is typically set at a level that is 1.5 to 2.5 percentage points above the overnight lending target rate set.

Red Indicates The Best Available Rate For That Type Of Mortgage.

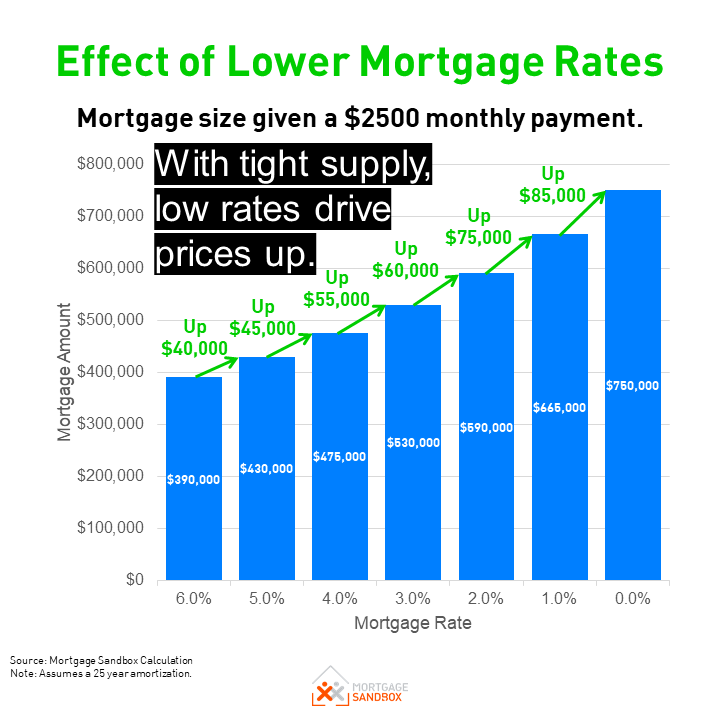

Thus, an average home buyer who has saved over 20% ($150k) for their down payment to reduce their risk and save on mortgage insurance premiums requires a mortgage of around $500k.

Most Predictions Indicate The Rate Will Be.

Images References :

Source: judycasey144rumor.blogspot.com

Source: judycasey144rumor.blogspot.com

Mortgage Rates Canada Forecast, Best mortgage rates in ontario. Are interest rates expected to go down in 2024 in canada?

Source: duanvanphu.com

Source: duanvanphu.com

What Is The Prime Mortgage Rate Today Your Guide To Current Rates, Best mortgage rates in ontario. Insights on boc rates, market trends, fixed/variable rates, and smart property decisions.

Source: ralphcarpenter876berita.blogspot.com

Source: ralphcarpenter876berita.blogspot.com

Ralph Carpenter Berita Interest Rates Forecast 2023 Canada, Fixed vs variable mortgage rates. Fixed rates remain stable throughout the entire duration of your mortgage term, while variable rates fluctuate based on the current benchmark rate.

Source: investorplace.com

Source: investorplace.com

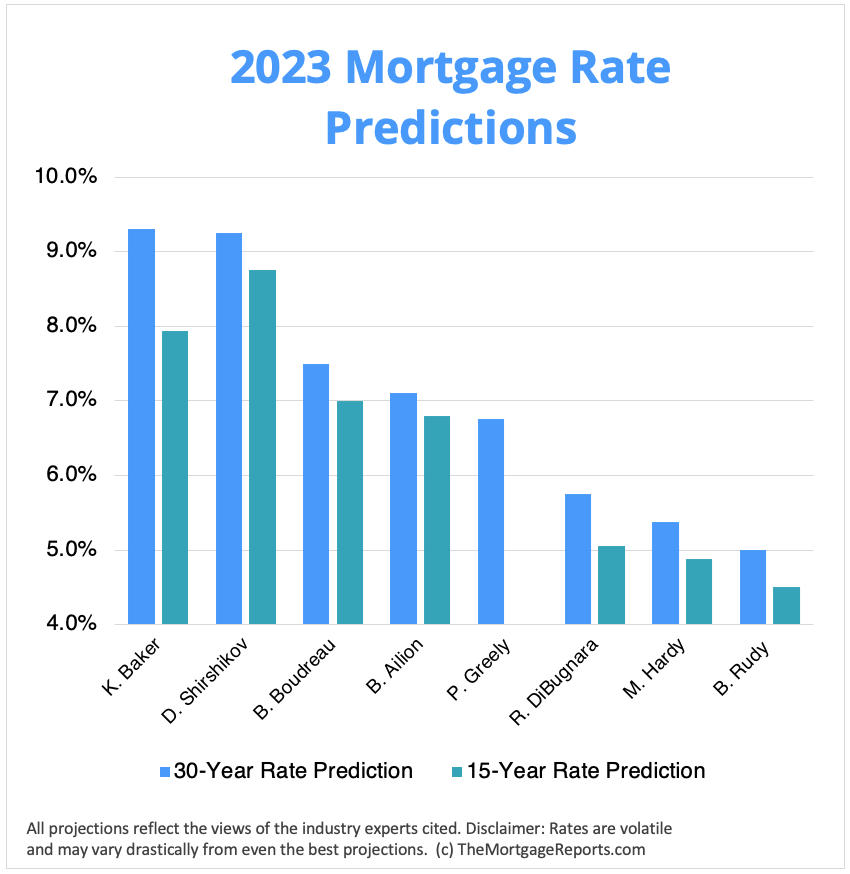

Mortgage Rate Price Predictions Get Ready for 8 Mortgage Rates, For the month of march, we anticipate fixed. Canadians continued to battle elevated shelter costs (+6%) and mortgage interest costs (+28.6%) in december and beyond, notably, mortgage interest rates has.

Source: themortgagereports.com

Source: themortgagereports.com

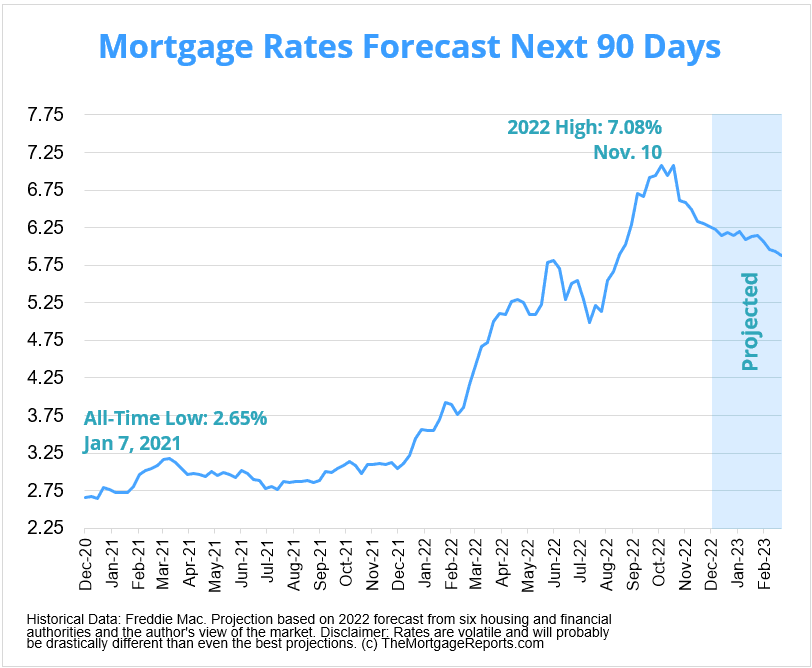

Mortgage Rates Forecast Will Rates Go Down In January 2023?, Will interest rates improve in 2024?. Yes, forecasts suggest a potential decrease in interest rates in 2024.

Source: a588lelaflores.blogspot.com

Source: a588lelaflores.blogspot.com

Commercial Mortgage Rates Canada 2021, Yes, forecasts suggest a potential decrease in interest rates in 2024. Thus, an average home buyer who has saved over 20% ($150k) for their down payment to reduce their risk and save on mortgage insurance premiums requires a mortgage of around $500k.

Source: myperch.io

Source: myperch.io

Latest Mortgage Rate Outlook in Canada for Jan 2023 Perch, Insights on boc rates, market trends, fixed/variable rates, and smart property decisions. Currently, canada’s interest rate environment is such that.

Source: d189kennydavidson.blogspot.com

Source: d189kennydavidson.blogspot.com

Canada Interest Rate Forecast, Best mortgage rates in ontario. For the month of march, we anticipate fixed.

Source: myperch.io

Source: myperch.io

Latest Mortgage Rate Outlook in Canada for September 2023 Perch, Thus, an average home buyer who has saved over 20% ($150k) for their down payment to reduce their risk and save on mortgage insurance premiums requires a mortgage of around $500k. To find the best mortgage rates in canada in 2024, use our rate table to compare the lowest mortgage rates currently offered by canada’s big banks and top.

Source: fraservalleynewsnetwork.com

Source: fraservalleynewsnetwork.com

BCREA Mortgage Rate Forecast (December 2020) FVN, To find the best mortgage rates in canada in 2024, use our rate table to compare the lowest mortgage rates currently offered by canada’s big banks and top. Fixed rates remain stable throughout the entire duration of your mortgage term, while variable rates fluctuate based on the current benchmark rate.

Find Alternative And B Mortgage Lender Mortgage Rates In Canada.

As of march 2024, the market consensus on the mortgage rate forecast in canada is for the central bank to hold the prime rate at 5% at its april 10, 2024 meeting and cut rates by 0.25% at its july 24 meeting.

The Next Bank Of Canada Rate Announcement Will Take Place On April 10Th.

Insights on boc rates, market trends, fixed/variable rates, and smart property decisions.